Maximising returns from inventory investments often poses a challenge for retail directors. Understanding Gross Margin Return on Inventory (GMROI) is crucial, as it directly reflects a company’s profitability relative to its stock levels.

This guide unlocks the secrets of GMROI, equipping you with the knowledge to enhance your inventory’s financial performance. Discover how smarter inventory decisions can boost your bottom line.

Key Takeaways

GMROI is a vital metric for retail businesses, quantifying the profit earned from every pound invested in inventory. It informs directors about the efficiency of sales and purchasing strategies.

To calculate GMROI, divide gross margin by average inventory cost. This calculation helps retailers manage their stock levels effectively and focus on investing in high-profit products.

Improving forecast accuracy and optimising pricing are strategic ways to increase GMROI. Regularly reviewing these areas can lead to better-aligned inventory levels with consumer demand and enhanced profitability.

Ensuring supply chain efficiency is crucial for a good GMROI score as it impacts carrying costs and turnover rates which directly affect profits from inventory investment.

The application of GMROI goes beyond calculations; it shapes decision – making across planning, financial management, pricing strategies, supply chain operations, and overall business strategy for driving growth.

Understanding Gross Margin Return on Investment (GMROI)

GMROI stands as a pivotal metric for retail businesses, offering clear insight into the performance of inventory investments. This ratio measures how much gross profit is earned for every pound invested in stock, providing retail owners with valuable information on gross margin return on inventory investment, gross margin return on inventory investment and potential return on investment.

Retailers leverage GMROI to gauge whether they are managing their inventory efficiently and generating sufficient sales from it – key factors in maintaining robust financial health.

Directors often scrutinise this figure because it sheds light on the effectiveness of purchasing decisions and pricing strategies. A strong GMROI indicates healthy turnover rates and sound, healthy retail business practices, while a lower value could signal an urgent need for changes within inventory management or cost control.

As investors and retailers keep a keen eye on profitability indicators like GMROI, store managers must continually look for ways to optimise their approach – a segue into our next topic: Key Takeaways on GMROI.

Quick Overview on Gross Margin Return on Inventory (GMROI)

Understanding GMROI is a powerful step in mastering the financial dynamics of the retail business. This ratio not only measures profitability but also acts as a guide for inventory investment decisions.

By grasping its concepts, directors can steer their businesses towards more efficient and profitable operations. Keep these points in mind to stay ahead in competitive markets.

Up next, let’s delve into the nuts and bolts of how exactly you calculate this crucial metric.

How to Calculate Gross Margin Return on Inventory (GMROI)

Discover the simplicity of gauging your inventory’s profitability with our clear-cut method for calculating Gross Margin Return on Inventory, a crucial metric that could transform your retail strategy – read on to unlock this financial insight.

Gross Margin Return on Inventory (GMROI) Formula

The GMROI formula is straightforward yet powerful – it’s the gross profit divided by average inventory cost. This calculation reveals how much a company earns for every pound invested in stock.

It serves as a critical metric, providing insight into the efficiency of inventory management and helping shape strategies to maximise profitability.

Calculating GMROI encourages directors to focus on both margins and turnover rates. It pushes beyond mere annual sales volume, spotlighting the importance of selling inventory at a significant profit while maintaining optimal stock levels.

Employing this tool guides businesses in fine-tuning purchasing decisions and pricing policies effectively, ensuring they invest in their most profitable items.

Gross Margin Return on Inventory (GMROI) Calculation Example

Calculating GMROI effectively showcases the profit earned for each pound invested in inventory. It’s a straightforward process that can lead to insightful analysis on inventory management.

Begin with determining your gross margin, which is the difference between sales and the cost of goods sold (COGS). If your retail store made £500,000 in sales last year and COGS was £300,000, your gross margin would be £200,000.

Find out the average inventory cost. Assume your beginning inventory was £100,000 and the ending inventory came to £150,000. Adding these together (£250,000) and dividing by 2 gives you an average inventory cost of £125,000 for that period.

Apply the standard GMROI formula: Gross Margin / Average Inventory Cost. Using our figures, divide your gross margin (£200,000) by the average inventory cost (£125,000).

Complete the division to arrive at a GMROI figure. In this case it would be 1.6 (£200,000 ÷ £125,000).

Interpret this result to understand its significance for your business. A GMROI of 1.6 means that for every pound you invest in inventory, you’re earning £1.60 back in profit over costs.

Compare this result against industry benchmarks to gauge performance. For general retail, aim for a number at or above 3.2 according to some industry guidelines.

The Application of Gross Margin Return on Inventory (GMROI)

The application of GMROI extends beyond mere calculation, offering a multifaceted lens through which to enhance business decision-making across various domains – discover how this metric can transform your strategic planning.

Planning

Planning is the strategic backbone of sound inventory management and capitalising on GMROI can significantly enhance this critical process. Directors must understand that effective planning with GMROI involves analysing the delicate equilibrium between sales revenue, gross profit and margins, and the costs associated with holding inventory.

Using this key performance indicator ensures that resources are allocated efficiently, providing a clear direction for future investments in stock.

Crafting a thoughtful strategy around GMROI enables a company to identify underperforming assets quickly and adjust purchasing decisions accordingly. This fosters informed decision-making which can improve not only profitability but also cash flow – a vital consideration for any retailer striving to stay competitive in today’s market.

With precise planning based on reliable metrics like gross margin return on inventory and gross margin return on investment, businesses are better equipped to meet their financial goals and adapt swiftly to changing market demands.

Financial

GMROI serves as a critical indicator for Directors, revealing the effectiveness of inventory investment in generating profits. It functions much like a compass, guiding financial decisions to ensure that each product on your shelves contributes positively to your bottom line.

Investing capital wisely in inventory can make or break profit margins for retailers; therefore, understanding and applying GMROI enables better decision-making in purchasing and sales strategies.

This metric assists you in evaluating if funds are tied up in slow-moving stock or if investments are fuelling high-yield returns. A robust GMROI reflects astute financial stewardship, showing shareholders and analysts that management possesses the acumen to balance sales momentum with cost-effectiveness.

Mastery of this ratio empowers leaders with actionable insights into optimising shareholder’s equity through strategic inventory management.

Inventory

Managing inventory effectively is crucial for maximising GMROI. Directors must understand that the way inventory is handled directly impacts a company’s liquidity and profitability.

Keeping tabs on average inventory cost is vital, as it influences the gross margin return on investment. Smart inventory management involves analysing stock levels to avoid overstocking or stockouts, both of which can erode GMROI.

Investing in robust inventory management systems can streamline this process, ensuring data accuracy and aiding in decision-making.

Optimising your stock means more than just monitoring numbers; it’s about understanding customer behaviour and forecasting demand accurately. This approach helps to align inventory purchases more with sales trends, improving turnover rates and reducing holding costs — all essential factors for a healthy GMROI.

Clear strategies for managing markdowns, promotions, and clearance items will also safeguard margins without letting unsold merchandise accumulate dust on shelves. Every piece of merchandise should earn its keep on the balance sheet by losing money or contributing positively to your overall investment returns.

Pricing

Harnessing the power of GMROI empowers businesses to refine their pricing strategies, creating a formidable tool for driving profitability. Smart pricing decisions are essential for maximising returns on inventory investments.

By leveraging GMROI inventory analysis alone, companies can pinpoint products that linger too long on shelves and implement dynamic pricing tactics. These adjustments help clear out slow-moving stock and rejuvenate sales figures.

Developing a keen insight into how GMROI influences pricing enables firms to align product prices with overall financial objectives effectively. Focusing on inventory that underperforms allows retail managers to recalibrate or cut prices in a way that promotes faster turnover without sacrificing revenue – a delicate balance made possible through rigorous application of GMROI metrics.

This strategic approach particular product and ensures each item’s price contributes positively to the business’s financial health and growth trajectory.

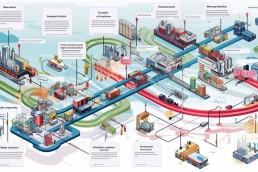

Supply Chain

Ensuring products are priced effectively is only one piece of the puzzle; the supply chain also plays a crucial role in maximising GMROI from selling products. A well-managed supply chain can reduce costs and improve inventory turnover, both key factors in boosting GMROI.

Retailers need to oversee their relationships with suppliers meticulously, making certain that they negotiate favourable terms and maintain efficient operations. This strategic approach helps minimise carrying costs and reduces the risk of stockouts or excess inventory – both potential drains on profitability.

Streamlining logistics means investing time into understanding market demand and coordinating closely with manufacturers to align production schedules with consumer needs. Cutting-edge inventory management software can aid retailers by providing analytics for better stock control, leading to more precise ordering and less wasted investment tied up in unsold goods.

By synchronising every link of the supply chain – from procurement through warehousing to checkout – retailers enhance their chances significantly at achieving a healthier return on investment measures each pound invested into their inventories, ultimately improving overall financial performance.

The Significance of Gross Margin Return on Inventory (GMROI)

Understanding the significance of GMROI unlocks crucial insights into how effectively a business is turning its inventory into profit, vital for directors seeking to optimise retail strategy and financial health—discover more on harnessing this powerful metric.

What does GMROI measure?

GMROI puts a spotlight on how well a company’s inventory is working to generate profit. It assesses the return received from every pound put into stock, highlighting the effectiveness of inventory management and sales strategies.

With this metric, leaders can gauge if their inventory investments are paying off by generating ample profits over time period over and above the costs of goods sold in grocery stores.

This key performance indicator shines a light on whether you’re getting enough bang for your buck when it comes to inventory spending. If your GMROI is soaring above industry average one, that’s reassuring news – it means you’re selling merchandise at more than what it cost to procure, indicating healthy profit margins.

Conversely, figures dipping below one signal an alarm; perhaps items linger, whether too much inventory, new inventory is too long on shelves or capital gets tied up in unsold stock. Focusing on GMROI empowers directors with critical insights necessary for steering profitability and maintaining competitive edge in retailing dynamics.

Why is GMROI useful?

Understanding the metrics that drive your business is crucial, and GMROI shines a light on how effectively a company turns inventory into cash above the cost. This key performance indicator goes beyond mere gross profit and calculations, delving into the relationship between net sales revenue and investment in stock.

It’s not just about what you turn and earn ratio though; it’s about how well your inventory investments perform.

Directors benefit from using GMROI as it provides clear insight into whether current inventory levels are contributing positively to the bottom line or tying up capital unnecessarily.

Applying this metric equips decision-makers with a robust gauge of financial health when considering stocking decisions across various product lines. By pinpointing which items generate strong returns and identifying underperformers, companies can streamline their shelf space and offerings for maximum efficiency and profitability – essential in competitive markets where resource allocation must be strategic to ensure long-term success.

GMROI Benchmarks by Industry

GMROI benchmarks act as essential indicators for businesses across various industries to evaluate inventory performance. These benchmarks offer valuable comparisons for directors seeking to understand how effectively their existing inventory and investment contributes to profitability. It’s important to keep in mind that these benchmarks can differ significantly between different industries due to the unique nature of their operations and market dynamics.

Here is a table illustrating GMROI benchmarks by industry:

| Industry | Recommended GMROI |

|---|---|

| Retail Clothing | 3.5 – 4.5 |

| Consumer Electronics | 3.0 – 4.0 |

| Home Furnishings | 2.5 – 3.5 |

| Building Materials | 2.0 – 3.0 |

| Automotive Parts | 3.0 – 4.0 |

| Pharmaceuticals | 1.5 – 2.5 |

| Food & Beverage | 4.0 – 5.0 |

| Jewellery | 0.5 – 1.5 |

Directors should note that these brackets serve as a general guide and the target GMROI can vary based on specific market segments, time periods, type of items, and other factors. For instance, a retail store typically aims for a GMROI of 3.2 or higher to ensure coverage of all occupancy and employee costs for certain period and to secure a profit.

Directors are advised to employ this data as a starting point to analyse and compare their current GMROI with industry standards, identifying areas for improvement. Now, let’s explore potential issues with GMROI and how to address them.

Potential Issues with Gross Margin Return on Inventory (GMROI)

GMROI may not account for the complexities of different business models within the retail industry. High-end brands with lower turnover rates, but higher margins, could find their GMROI data misleading when comparing to fast-moving consumer goods companies with razor-thin margins and high turnover.

This makes it tricky to set benchmarks or create actionable strategies without a deep understanding of your specific market segment.

Inventory valuation methods also play a role in skewing GMROI figures. The historical cost principle might not reflect true inventory value if market conditions fluctuate rapidly – think fashion items or technology products.

Consequently, directors must tread carefully, as relying solely on GMROI may overlook these nuances that are critical to making informed strategic decisions. Next on our agenda is exploring effective strategies to enhance GMROI in retail environments.

How to Improve Gross Margin Return on Inventory (GMROI) in Retail

Elevating GMROI in a retail setting hinges on the meticulous analysis and strategic adjustments of various operational facets. Retailers seeking an upward trajectory in their GMROI must delve into enhanced forecast accuracy, refined pricing techniques, and streamlined inventory expenditure to secure a more profitable return on inventory investment from their stock investments.

Improve Your Forecast Accuracy

Improving forecast accuracy is a critical step in enhancing GMROI. It empowers retailers to match inventory levels with consumer demand, avoiding overstock and stockouts.

Monitor buying patterns and customer behavior to anticipate future sales trends. Utilise point-of-sale systems to track historical data and analyse this information for predictive insights.

Implement machine learning algorithms that adapt to seasonality and trends, increasing the precision of your inventory forecasts.

Deploy advanced analytics tools to process large volumes of data for more nuanced demand projections. These tools can identify subtle shifts in buying patterns, helping you stay ahead of the curve.

Review your forecasts regularly against actual sales performance. Swiftly adjust your inventory planning to reflect real-time consumer demand.

Train your team on the importance of accurate forecasting. Encourage them to contribute their on-the-floor observations which might not be captured by data alone.

Collaborate closely with suppliers and use shared data for better forecast accuracy. This cooperative approach ensures all parties are aligned in their expectations.

Invest in an integrated forecasting system that combines various aspects such as marketing campaigns, economic indicators, and industry developments.

Engage with customers through feedback mechanisms like surveys or social media platforms. Direct input from consumers can provide valuable leads on future purchasing decisions.

Optimise Your Pricing

Effective pricing is a key driver of GMROI improvement. It directly influences both margins and the pace at which inventory moves.

Assess your current pricing strategy: Examine whether you’re using cost-plus, competitive, or value-based pricing and consider which best aligns with your brand and market positioning.

Monitor the competition: Stay informed about competitors’ pricing moves to ensure you remain competitive without needlessly undercutting profits.

Consider psychological pricing: Round numbers may not always be the most appealing. Experiment with prices ending in .99 or .97 to see if they drive more sales.

Implement promotional pricing wisely: Use discounts and promotions strategically to move stock without eroding perceived value or habituating customers to reduced prices.

Integrate markdown optimisation: Analyse data to time reductions for maximum appeal and minimum impact on margins. This can help clear out old stock without sacrificing too much profit.

Leverage price elasticity of demand: Determine how sensitive your customers are to price changes and adjust accordingly, possibly increasing prices where demand is less elastic.

Align prices with brand perception: High-end brands can often command higher prices due to customer perceptions of quality and prestige. Adjust prices if your brand equity supports it.

Use product bundling: Increase the perceived value by bundling products together at a slight discount, encouraging larger purchases while maintaining healthy margins.

Invest in a good POS system: Modern POS systems provide real-time data analytics that can help you make informed decisions about when to adjust pricing for optimal sales and inventory turnover.

Test different pricing options frequently: Regular testing allows you to understand what works best for different segments of your market, helping maximise both sales volume and profitability.

Cut Your Inventory Costs

Trimming inventory costs is crucial for enhancing your store’s GMROI. Implementing effective strategies for ending inventory cost can lead to significant savings and higher profitability.

Conduct regular inventory audits to ensure data accuracy. This can help identify slow-moving items that tie up capital.

Negotiate better terms with suppliers, such as bulk discounts or longer payment periods, which can free up cash flow.

Introduce drop – shipping for certain products to eliminate holding costs and reduce the risk of overstocking.

Embrace just-in-time (JIT) inventory methods to align purchases with consumer demand, decreasing the amount of stock held.

Utilise technology for inventory management, which can automate ordering processes, forecast demand more accurately, and prevent excess stock.

Analyse sales data to pinpoint less profitable or unpopular items and consider phasing them out of your portfolio.

Opt for consignment inventory where possible, keeping ownership with suppliers until the product sells, thus reducing carrying costs.

Leverage relationships with manufacturers for returns or rebates on unsold items, this could cut losses from unsold stock.

Foster a culture of lean inventory among staff; encourage them to understand and embrace efficient stock management practices.

Re-evaluate your safety stock levels based on historic sales trends and market analysis to avoid surplus without risking stock-outs.

Conclusion

In mastering GMROI, retailers unlock the same industry of potential to drive profits and streamline inventory management. It stands as an example of a critical gauge of retail health, guiding decisions from pricing to supply chain strategies.

Retail directors who leverage this powerful tool can expect improved company financial outcomes and a robust bottom line. Embrace the insights GMROI offers and watch your business thrive in a competitive marketplace.

Harness its power to elevate your retail strategy to new heights of efficiency and profitability.

FAQs

1. What does GMROI stand for?

GMROI stands for Gross Margin Return on Inventory, a key performance indicator that measures how much profit you earn from your inventory investment.

2. How do you calculate GMROI?

To calculate GMROI, divide the gross margin by the average inventory cost. You can use a the gmroi calculator, gross margin calculator or follow for example the inventory investment formula to calculate to get this figure.

3. Can small businesses like mum and pop shops use GMROI too?

Absolutely! Mum and pop shops can apply GMROI to analyse their revenue against stock held, optimising pricing and maximising profits with effective merchandising strategies.

4. Why is keeping track of shrinkage important in calculating GMROI?

Shrinkage affects both inventory levels and overall profitability; hence it’s crucial in assessing true costs when determining the return on your inventory investment using the GMROI method.

5. Does implementing EDLP (Every Day Low Prices) affect my store’s GMROI?

Yes, EDLP can influence your store’s gross margin which directly impacts your calculated GMROI – consider it as part of portfolio analysis for comprehensive financial strategies.

6. In what ways can supermarkets improve their turn-earn ratio through better merchandising?

Supermarkets enhance their turn-and-earn ratios by adopting savvy branding techniques which boost customer loyalty, alongside efficient safety stock methods that support continuous replenishment without overstocking.

Like what you see? Then subscribe to our email newsletter. It's not boring!

This is the email newsletter for professionals who want to be on the cutting edge of supply chain management. Every edition is full of fresh perspectives and practical advice.

Your privacy matters! View our privacy policy for more info. You can unsubscribe at anytime.

And there's more...